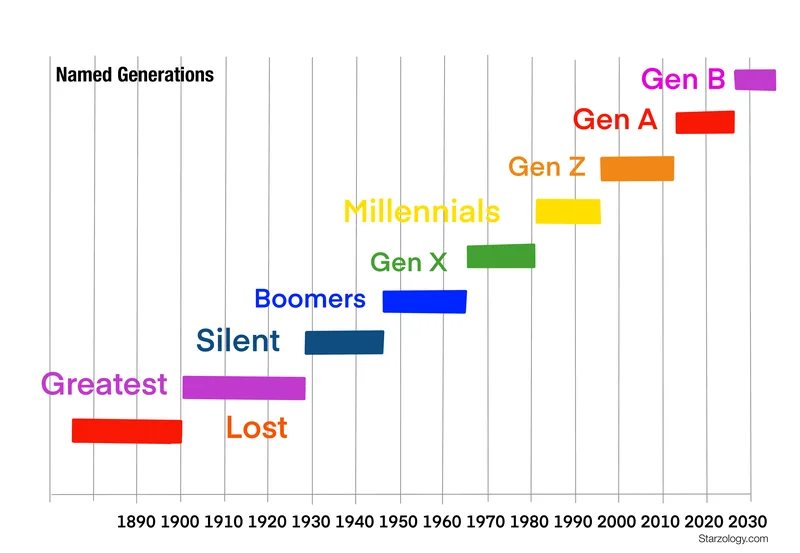

Gen Z's Defining Years: The Real Range & How It Compares to Millennials and Gen Alpha

The Labubu Effect: Emotion vs. Economics

Pop Mart is having a moment. A massive one. The Chinese toy retailer, fueled by the Labubu craze, reported a staggering 200% revenue increase for the first half of 2025, hitting 13 billion yuan (that’s $1.9 billion for those keeping score in USD). Net income jumped almost 400% to 4.5 billion yuan ($630 million). And it’s not just top-line growth; their stock is up over 125% since January. They even muscled their way into Hong Kong’s Hang Seng Index in September.

The engine driving this growth? Labubu, the creation of Hong Kong artist Kasing Lung. These dolls, part of "The Monsters" series, account for a third of Pop Mart’s total sales. Celebrities are flashing them, shoppers are lining up for them, and tennis stars are customizing them. Analysts are attributing this to “emotional” or “new” consumption among China’s youth—spending on hobbies and small pleasures. The year of the Labubu revealed the 'new consumption' trend among China's Gen Z—and now it's spreading overseas - Fortune

But here's the part of the story where I raise an eyebrow. Market cap is hovering around $37 billion. Then, almost as quickly as it rose, Pop Mart saw nearly $2.2 billion in market value evaporate after a salesperson’s unguarded comments about overpriced blind boxes were livestreamed. This isn’t just a blip; it’s a potential indicator of the fragility underpinning this explosive growth.

The Secondary Market Signal

The analyst narrative is that Gen Z (and perhaps some older millennials) are driving this trend, seeking emotional fulfillment through these collectibles. They're not just buying toys; they're buying experiences, community, and a sense of identity. Okay, makes sense. But let’s dig a little deeper.

Investors are reportedly getting antsy about declining secondary market prices for Labubu dolls. This is a critical data point that often gets glossed over. The secondary market is the real-time pulse of demand. It's where hype meets reality. If prices are dropping, it suggests that the initial frenzy is cooling off, and the perceived value isn't sustainable.

Think of it like this: a hot tech stock that everyone is raving about. The initial surge is exciting, but the true test is whether it can maintain those levels. If early investors start dumping their shares, and the price plummets, it signals a fundamental problem. The same principle applies to Labubu dolls. Declining secondary market prices suggest that the long-term demand may not justify the current valuation.

How reliable is this data? That's the question. Are these secondary market price declines statistically significant? Are we talking about a slight dip, or a major correction? The available data doesn't specify the magnitude of the decline, so it is difficult to determine if this is a minor fluctuation or a concerning trend.

Pop Mart's expansion outside of Greater China is noteworthy. 40% of their revenue now comes from international markets, up from less than 25% a year ago. This diversification could mitigate the risk of a domestic slowdown. Chinese brands like Luckin Coffee and Chagee are also expanding globally, tapping into the same consumer trends. However, it also introduces new challenges, such as navigating different cultural preferences and regulatory environments.