Ethereum Gas Limit: Fusaka's Strategic Move (Reddit Hype Train)

2025-11-29 01:08:156

Ethereum's "More is More" Approach: Is it Working?

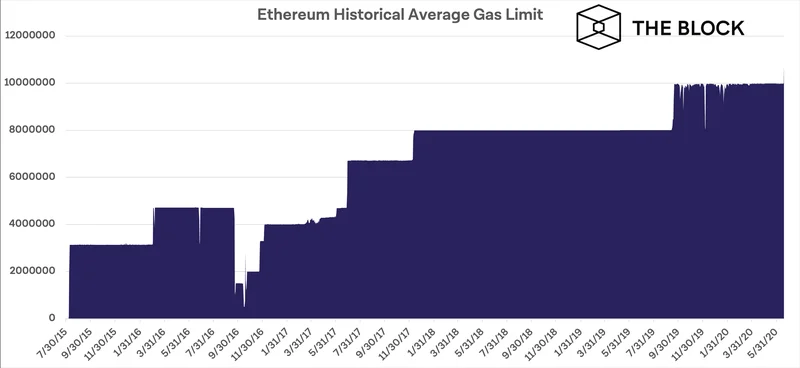

Ethereum's Need for Speed: A Data-Driven Look Ethereum's recent activity looks like a classic case of "more is more," but it's worth diving into the numbers to see if the network is actually getting more efficient, or just bigger. The block gas limit increase to 60 million (from 45 million) is certainly a headline grabber. Toni Wahrstätter called it the culmination of a year-long community effort. But what does that effort *actually* amount to in terms of real-world performance? The Fusaka hard fork, slated for December 3rd, is another piece of this puzzle. PeerDAS, the redesigned data availability sampling, sounds promising, with Vitalik Buterin calling it "key to Ethereum scaling." But promises are cheap; let's see if the data backs it up. The $2 million audit contest for Fusaka is a good sign—someone's putting their money where their mouth is, at least. Ethereum scaling networks hitting 31,000 transactions per second (TPS) is the kind of number that gets people excited. Ethereum Raises Gas Cap To 60M Ahead Of Fusaka And Record-Breaking TPS - CoinCentral Lighter, a perpetuals-focused zero-knowledge rollup, is apparently leading the charge with around 5,455 TPS. This is the part of the report that I find genuinely interesting. How much of that TPS is *real* economic activity, and how much is just bots trading with themselves to juice the numbers? It's a question nobody seems to be asking.Gas Limit Hike: Real Solution or Just a Band-Aid?

Cracks in the Foundation? EIP-7623, which introduces protocol-level block-size safeguards, is crucial here. Without safeguards, you risk a bloat problem that makes the whole system unwieldy. Still, safeguards or not, the network's performance hinges on more than just raw throughput. Zhixiong Pan says the gas limit increase is possible due to EIP-7623, client optimizations, and testnet results. Testnets are great, but they aren't the real world. The analysts' takes are all over the map, which is typical. Ted Pillows is worried about Ethereum forming a new low unless it breaks above a key resistance level. Michaël van de Poppe is eyeing a breakout level for the ETH/BTC pair. Merlijn The Trader sees recurring wave structures that often lead to price surges. Technical analysis is always a Rorschach test; you see what you want to see. I tend to put more stock in on-chain data. The increase from 45 million to 60 million gas—to be more exact, a 33.33% increase—is significant, but it's not a magic bullet. It's like widening a highway: if the on-ramps are still clogged, you haven't solved the traffic problem, you've just moved the bottleneck. The real question is whether the underlying architecture can handle the increased load without sacrificing security or decentralization. Is the Juice Worth the Squeeze? The community's year-long push for higher capacity is understandable. Everyone wants faster, cheaper transactions. But are we optimizing for the right things? Are we sacrificing long-term stability for short-term gains? Are we sure that these scaling solutions aren't just creating new attack vectors? The fundamental question remains: Is Ethereum truly scaling, or is it just becoming a faster, more complex version of its old self? A House Built on Sand?